403(b) and 457 Savings Plans

Retirement

All retirement planning sessions with TIAA, Fidelity, Mission Square (formerly ICMA) and VRS are available through the signup links below. You can choose to meet virtually or in-person.

All retirement planning sessions with TIAA, Fidelity, Mission Square (formerly ICMA) and VRS are available through the signup links below. You can choose to meet virtually or in-person.

To learn how to make the most of your appointment, watch this video developed by TIAA.

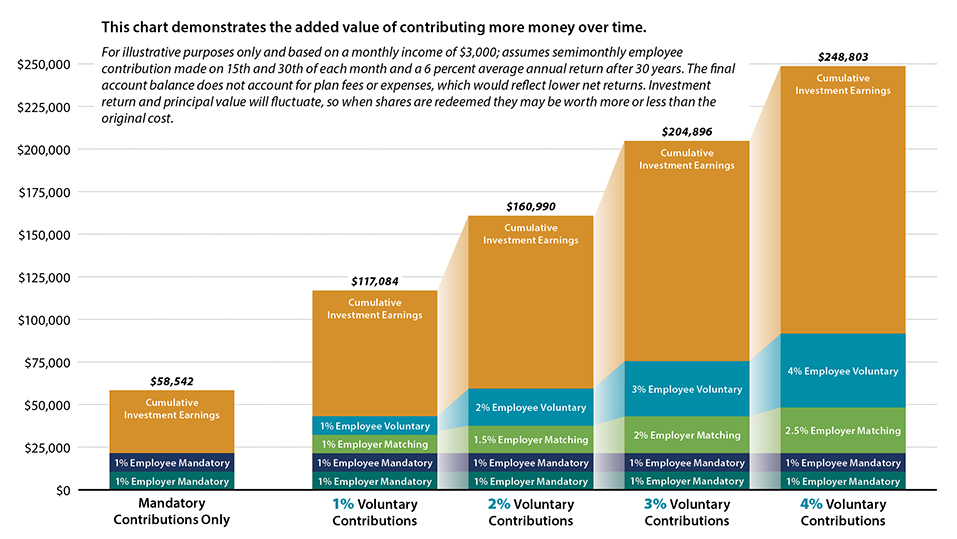

Supplemental savings plans 403(b) and 457 allow you to invest additional money pre- or post-tax. They are also available to most employees who may not have a retirement plan through VRS, ORP, or MCRP.

If you participate in the ORP, MCRP, or VRS plan, you are eligible for a cash match from UVA when you enroll in a 403(b) or 457 savings plan. Please see details in the accordions below.