Retirement Elections for New Hires

Retirement may be years or even decades away, but to be prepared for your financial future, it's important to prioritize those savings from the very start.

Retirement Elections for New Hires

Retirement may be years or even decades away, but to be prepared for your financial future, it's important to prioritize those savings from the very start.

ENROLL IN A RETIREMENT PLAN

Enrollment in a core retirement plan is mandatory for benefited employees. Some employees may have one plan option, while others may have a choice between two plans in their new hire benefits task in Workday.

If you have a choice between two plans, review resources to make an informed decision. Your choice is irrevocable; you cannot change your core retirement plan once you have enrolled.

Timing & extra deductions

Your retirement plan is retroactive to your date of hire; any missed deductions needed to catch you up to this date will occur after you submit your benefits elections. The longer you wait to submit, the more likely it is you will experience extra deductions.

ATTEND BENEFITS ORIENTATION

Attending benefits orientation is the best way to understand the benefits available to you and get answers to your questions. The presentation lasts an hour and is presented by a Benefits Counselor live via Zoom, so you can access from wherever you are.

Academic orientation information

UVA Health orientation schedule; see your new hire email for links to our online orientation.

NEED HELP?

Contact the HR Solution Center with your questions .

SAVE MORE FOR RETIREMENT

Take advantage of additional voluntary contributions to grow your savings for retirement. Most employees are also eligible for an employer cash match!

These optional, supplemental plans can be changed at any time.

Learn more about the plans, how to enroll, and the cash match.

LOGIN TO YOUR ACCOUNTS

Create a login and password for your retirement accounts after you are enrolled and contributions have started. This is where you can name beneficiaries, change investments, and keep track of your savings.

Enrolling in a retirement plan is mandatory for benefited employees. If you do not submit your new hire elections by the deadline, you will be placed in a default retirement plan.

Benefited New Hire Retirement Plans*

Visit our retirement page for more information.

*Some employees with prior state service or transferring from another state agency may have different options based on eligibility.

If you have a choice between two plans, review resources to make an informed decision. Your choice is irrevocable; you cannot change your retirement plan once you have enrolled.

New benefited academic staff who are non-exempt will enroll in the VRS Hybrid Plan.

Non-exempt staff who are participants in one of the older VRS 1 or VRS 2 plans and did not take a refund of that plan may resume participation in that plan.

Learn more:

Benefited faculty members and benefited academic Managerial & Professional (exempt) staff will have a choice* between:

If you have a choice between two plans, review resources to make an informed decision. Your choice is irrevocable; you cannot change your retirement plan once you have enrolled.

Participants in one of the older VRS 1 or VRS 2 plans who did not take a refund of that plan may resume participation in that plan.

*If the employee is a direct transfer from another state agency and previously chose between a VRS plan and ORP, they are not eligible to choose again; they would remain in the same plan.

Benefited UVA Health (Medical Center) team members will enroll in the Medical Center Retirement Plan (MCRP).

Previous participants in one of the older VRS 1 or VRS 2 plans who did not take a refund of that plan may resume participation in that plan.

Previous VRS Hybrid participants are not able to participate in the Hybrid as a Medical Center Team Member.

Click on a topic below for details in guiding you to maximize your retirement benefit as you begin your career.

As a University employee you are eligible to enroll in one or both of the additional retirement savings plans known under IRS regulations as 403 (b) and 457 programs.

Most employees are also eligible for an employer cash match!

In 403(b) and 457 programs you can set aside funds either after tax under a Roth provision or tax-deferred (reducing your taxable income now), up to the IRS max for the year.

Employees enrolled in the VRS Hybrid plan can only enroll in 403 (b) and 457 programs after maxing out their VRS Hybrid plan by contributing the maximum voluntary 4% to the defined contribution portion of their VRS Hybrid plan with Voya, and can receive up to a 2.5% cash match for those contributions. Learn how.

Learn more about your voluntary contribution options and the cash match.

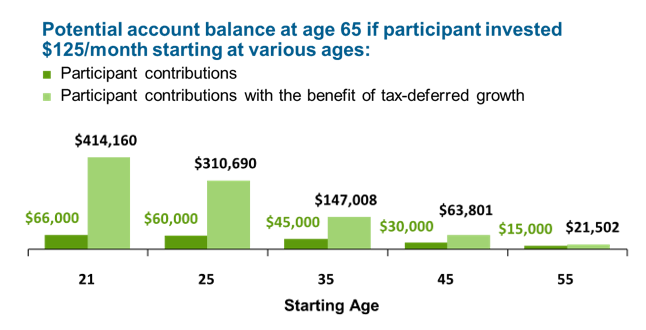

Here you can see the power of compounding. The earlier you begin contributing to your retirement, the more time that money has to grow.

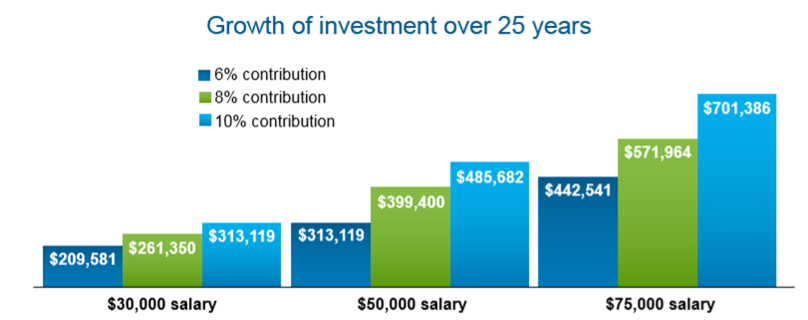

This graph shows how much more you accumulate by investing 8% or 10% of your income versus 6% at different salary levels.

Invest your retirement funds wisely. If you don't choose a fund, your contributions will default to a "Target Date" fund based on your age that will automatically adjust investments as you get closer to retirement age.

You may request assistance from the representatives of your chosen provider via the numbers listed below.

Generally, you can leave your retirement assets in the plan at your previous provider, move them to your current retirement plan, roll to an IRA, or take a cash distribution (be aware of potential tax penalties).

Learn more about consolidating retirement accounts.

Learn important financial terms.