UVA Health Plan/Pharmacy

Health Plan Communications:

Mammogram coverage

UVA Aetna Health Plan follows American Cancer Society Guidelines and offers 100% no cost to member for mammograms.

2nd.MD

Effective January 1, 2025, your UVA medical benefits will include a new program called 2nd.MD. This program offers access to top board-certified specialists for expert medical opinions. If you ever feel uncertain about a diagnosis or treatment plan, 2nd.MD can connect you with a specialist via phone or video for a second opinion. Check out the welcome flyer to learn more.

Consolidated Appropriations Act (CAA) / No Surprises Act (NSA)

The UVA Health Plans comply with the Consolidated Appropriations Act (CAA), the No Surprises Act, and the Transparency in Coverage Final Rule. Aetna creates and publishes the machine-readable files on behalf of the UVA health plans posted to the UVA Health Plan’s Aetna microsite, which houses pricing information including negotiated service rates and out-of-network allowed amounts between the health plan and healthcare providers.

When Benefits Begin

Your medical, dental, and/or vision benefits can begin on the first date of employment for most new hires* (or choose to wait until the first of the month if you have coverage elsewhere).

- Date of employment: If you need coverage immediately, you have the option to start your medical, dental, and/or vision benefits as of your date of employment. This may be a good option if you are currently not covered elsewhere, or you desire coverage as soon as possible.

- * When enrolling in benefits due to a UVA “change job” or “transfer," coverage begins on the first of the month following the event date. If the event date is on the first of the month, coverage begins immediately.

- First of the month following your date of employment: You can choose to start your medical, dental, and/or vision benefits on the first of the month after you are hired. This may be a good option if you have coverage from a previous employer or are under a family member’s coverage that is still active through the end of the month. However, if you are hired on the first of the month, your benefits coverage begins on your first date of employment; you cannot start coverage the following month.

- No medical, dental, and/or vision coverage: You can officially waive your medical, dental, and/or vision benefit options as well as enroll or waive in other benefits during your new hire change benefit event.

Please review the Coordination of Benefits document regarding your coverage and how it works with your prior employer.

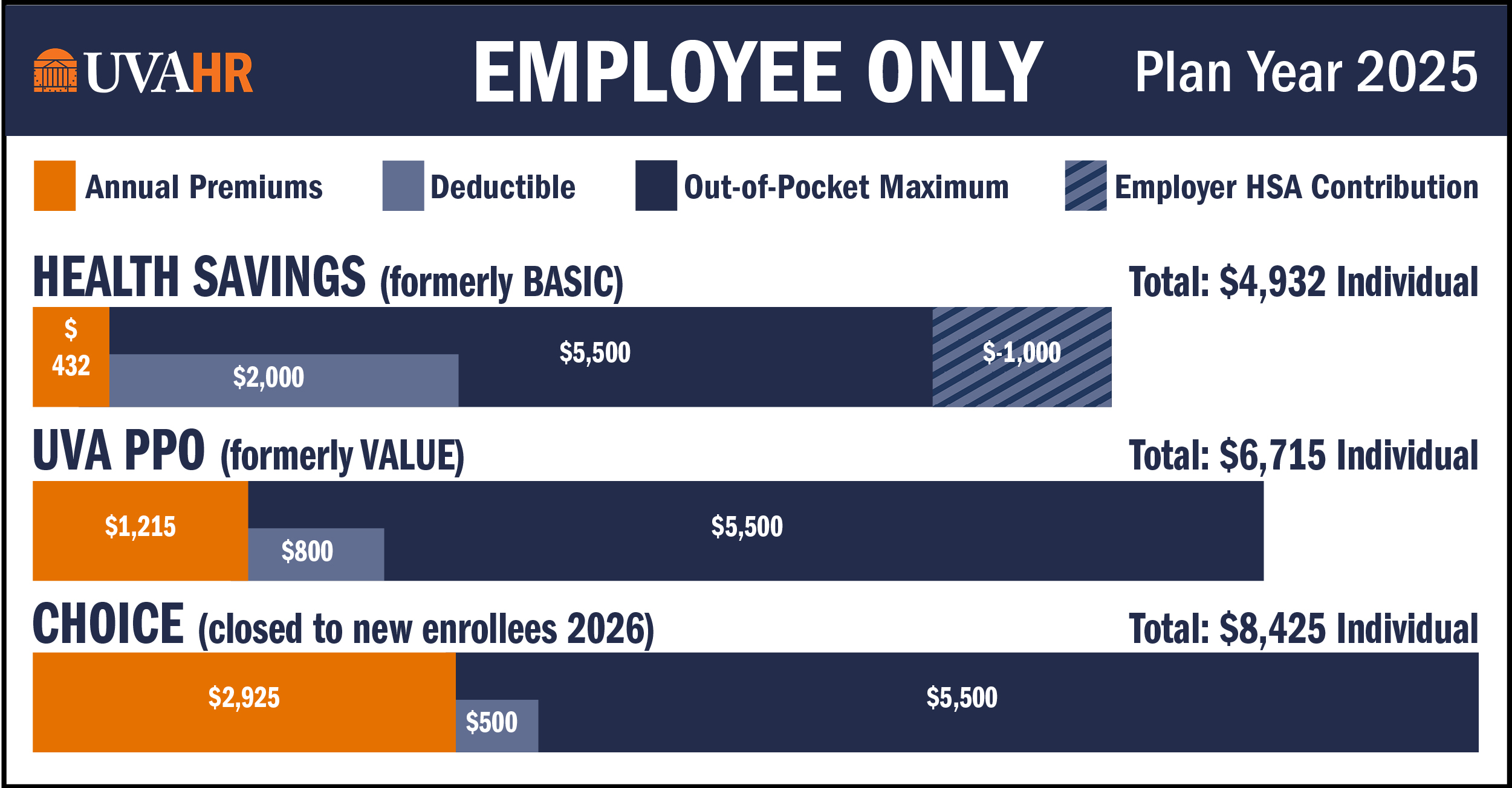

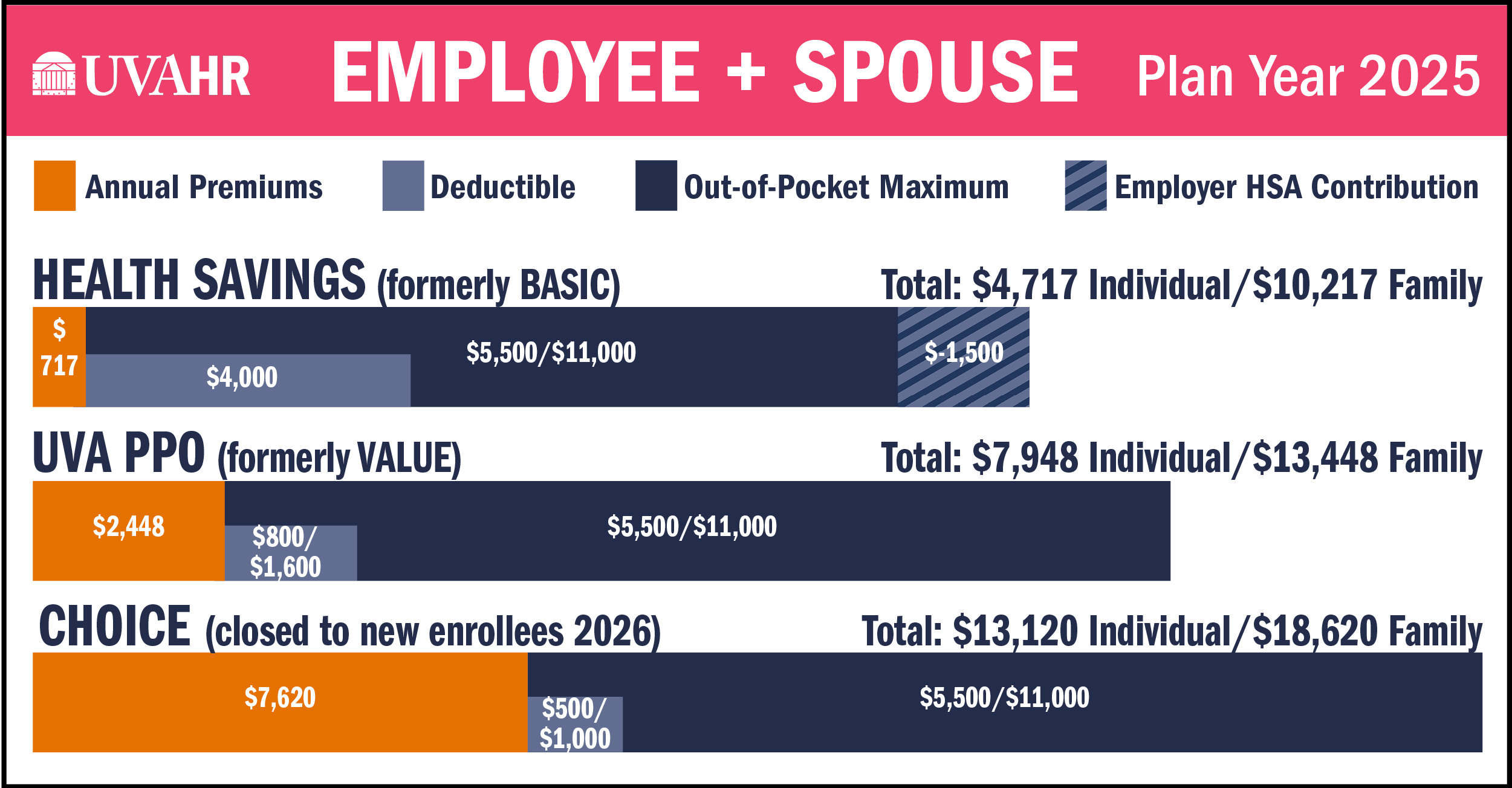

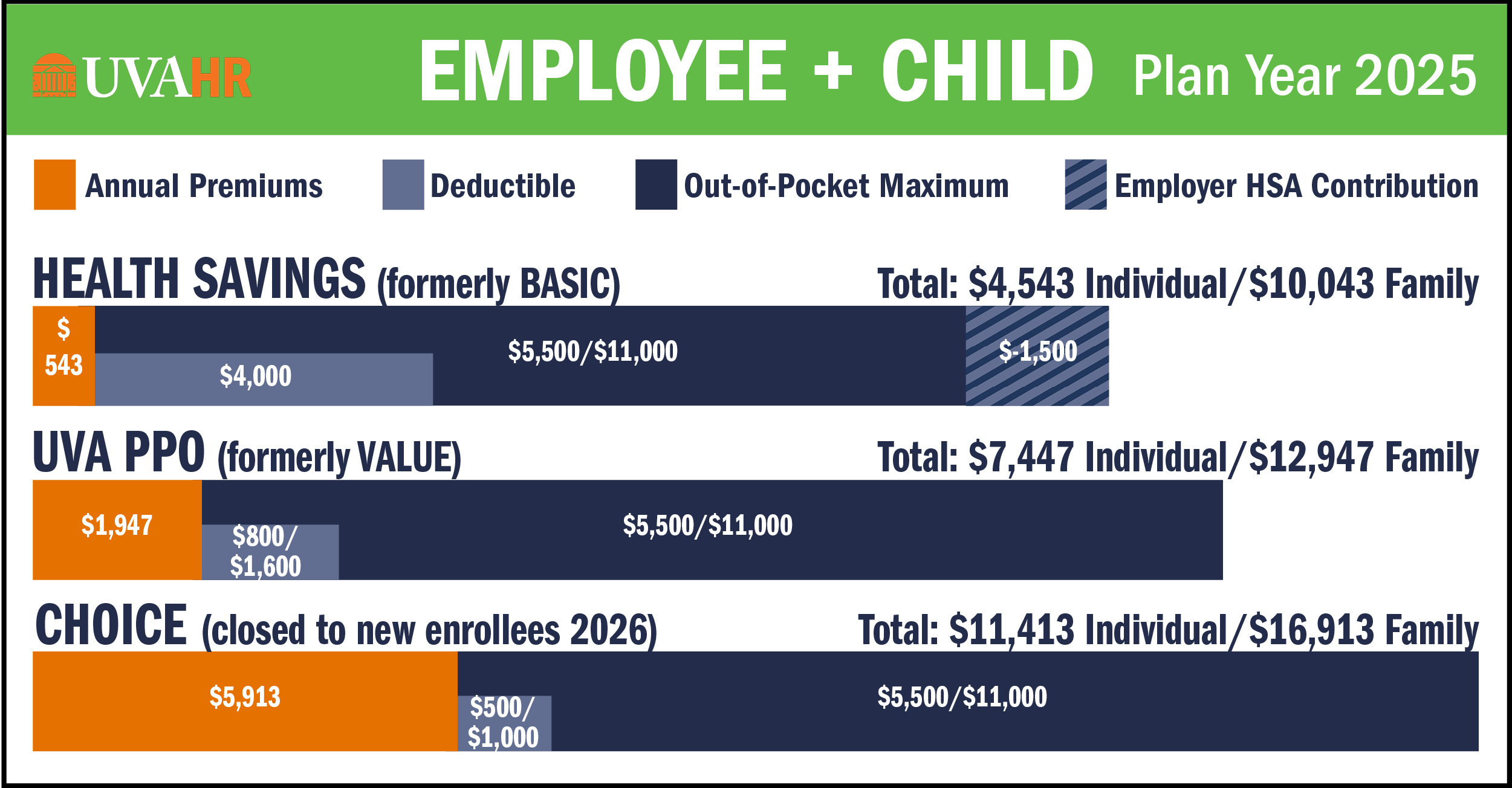

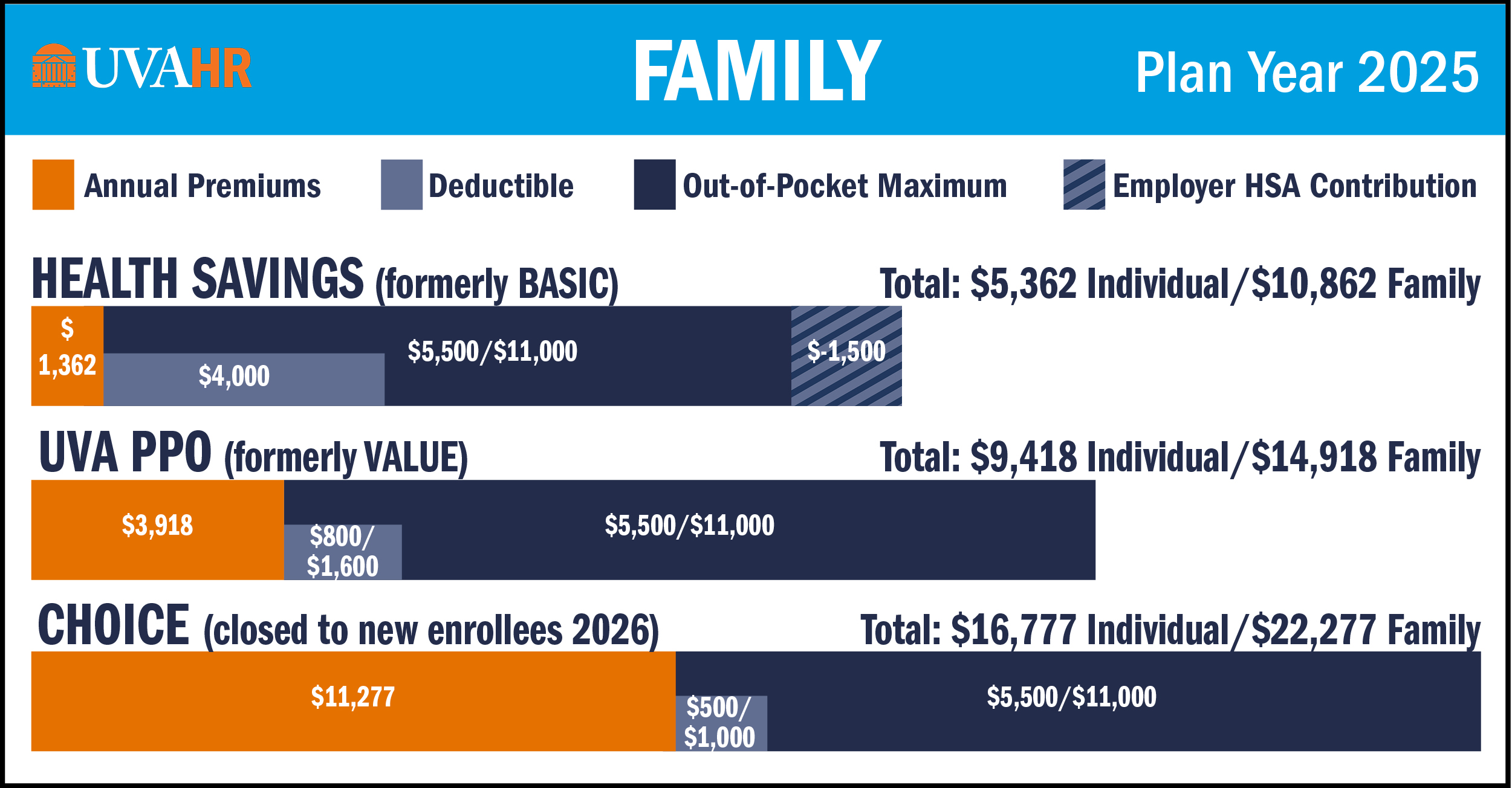

Every UVA employee has different benefits needs, and you have 3 health plan options to choose from to meet your needs. All options are administered by Aetna:

- Health Savings (formerly called Basic; High Deductible Health Plan - HDHP)

- UVA PPO (formerly called Value Health)

- Choice Health (closed to new enrolling starting 1/1/2026)

NEW: Enjoy these NEW short videos that explain key benefits concepts: