Supplemental Retirement Savings Options

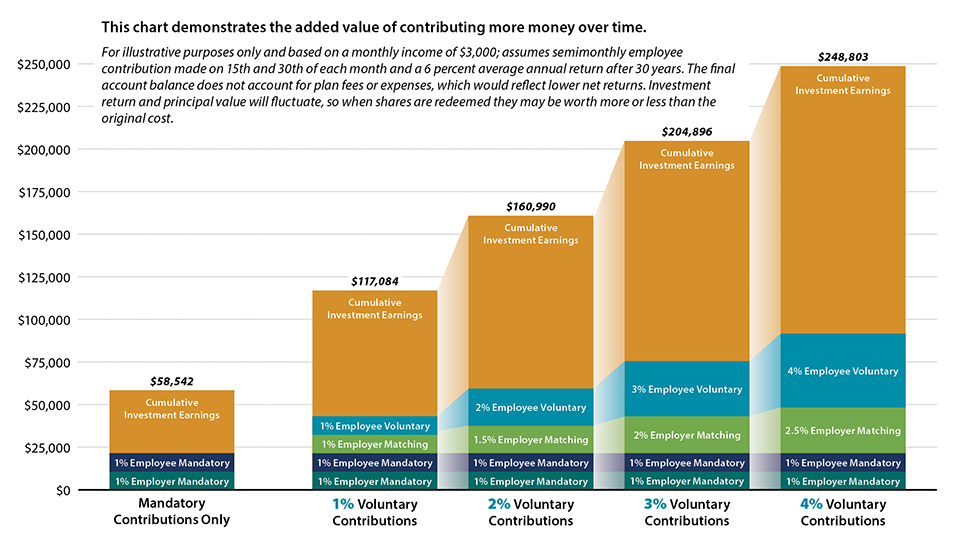

How Can I Save More for Retirement?

-

Enroll in a supplemental 403(b) and/or 457 retirement savings plan; see details below.

-

VRS Hybrid participants have an option to increase their Hybrid contributions.

-

The best time to save is now; the earlier you start, the longer your money has time to grow. Check out these resources: