Defined benefit + defined contribution. Here’s how it works:

Defined Benefit Component

A defined benefit pays a monthly retirement benefit based on age, total service credit, and average final compensation.

- VRS manages investments - and related risk.

- Employees contribute a mandatory 4% of creditable compensation / month.

- UVA makes a separate contribution directly to VRS on behalf of all covered employees.

- Normal retirement age is the Social Security retirement age.

Contact VRS at 1.855.291.2285 or vrshybridsupport@varetire.org with questions.

Defined Contribution Component

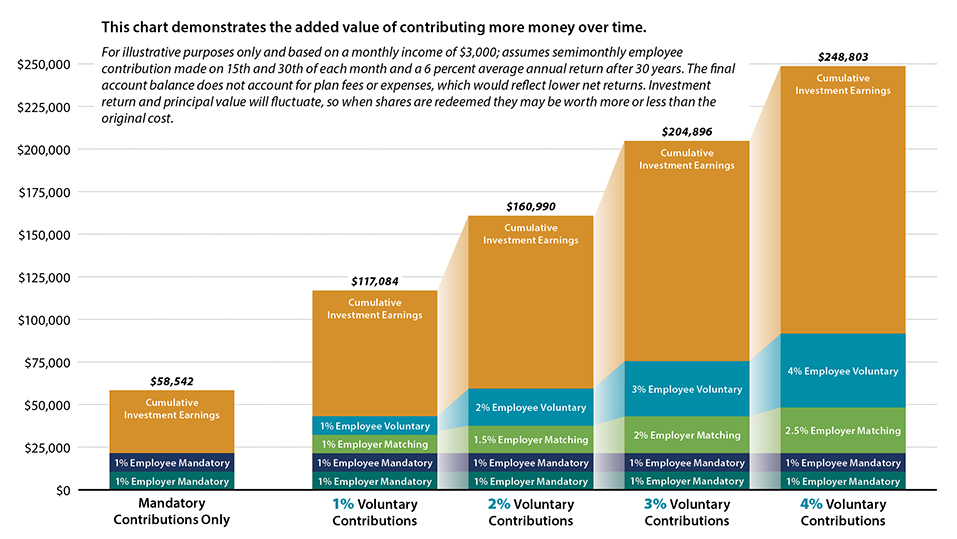

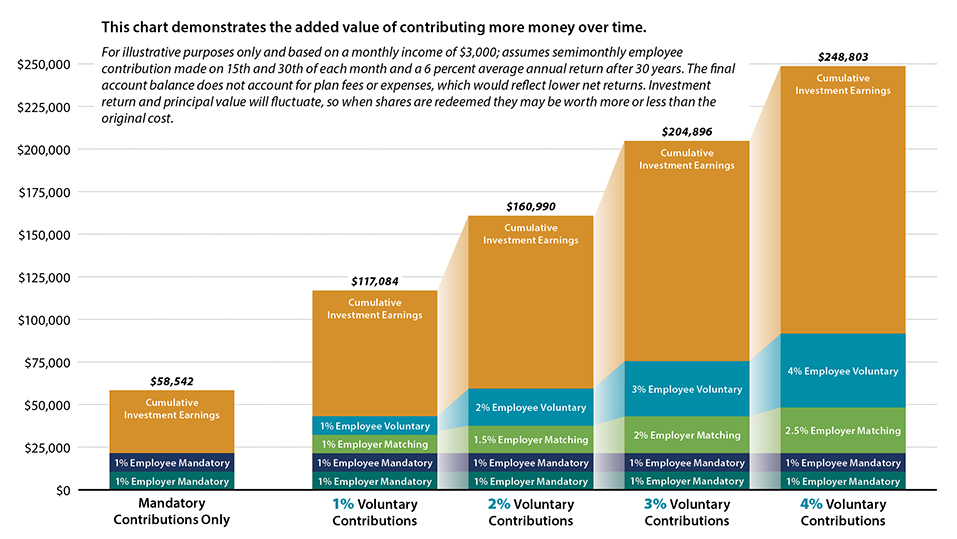

A defined contribution pays a retirement benefit based on contributions by you and your employer, as well as the investment performance of those contributions. The more voluntary contributions you make, the more your benefit will increase.

- You manage investments - and related risk.

- You contribute a mandatory 1% of your creditable compensation each month to the Hybrid 457 Deferred Compensation Plan and receive a 1% cash match to the Hybrid 401(a) Cash Match Plan

- You may also voluntarily contribute up to 4% of your salary to the Hybrid 457 Deferred Compensation Plan and UVA will match up to 2.5% in the Hybrid Cash Match Plan

- Make the maximum contribution in the 457 program and you become eligible for the 403(b) savings program, where you receive a 50% match (up to $40/month)

- You may receive distributions upon leaving employment, subject to restrictions

The chart below shows the long-term advantage of saving up to 4% of your income in a deferred savings plan.

Contact Voya Financial at 877.327.5261 with questions.

Key Resources