Earn Rewards for Enhancing Your Well-Being

Hoos Well, UVA’s award-winning well-being program, helps faculty, staff, and team members build healthy habits and foster a healthier and happier work environment. Research shows that participating in employee well-being programs can improve health, happiness, productivity, morale, and quality of work life. We invite you to participate in the wide range of evidence-backed programs and resources that Hoos Well offers to boost your well-being, flourish, and thrive.

Beginning February 2, 2026, employees and spouses enrolled in the UVA Health Plan or UPG Anthem Health Plan can earn up to $500 each by completing healthy activities—like taking a health assessment, getting a well check or flu shot, joining challenges, tracking habits, and more.

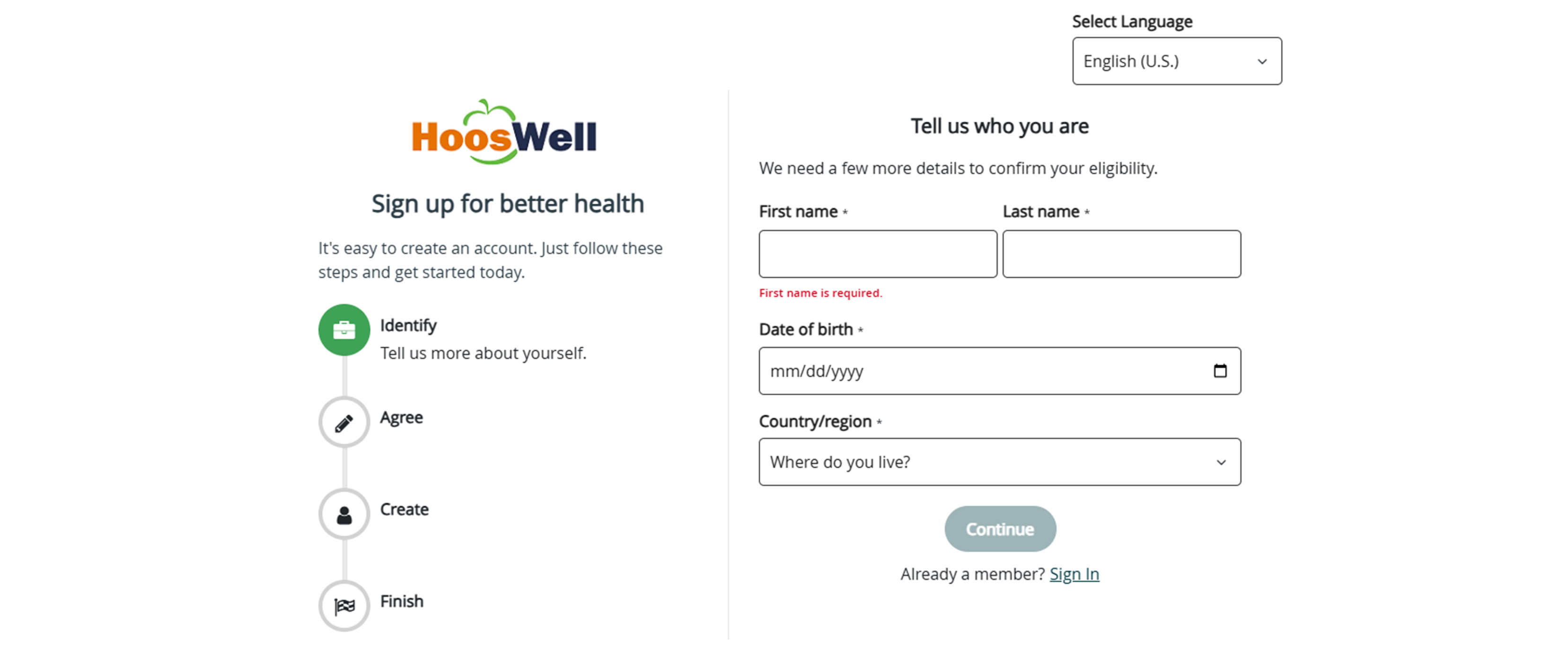

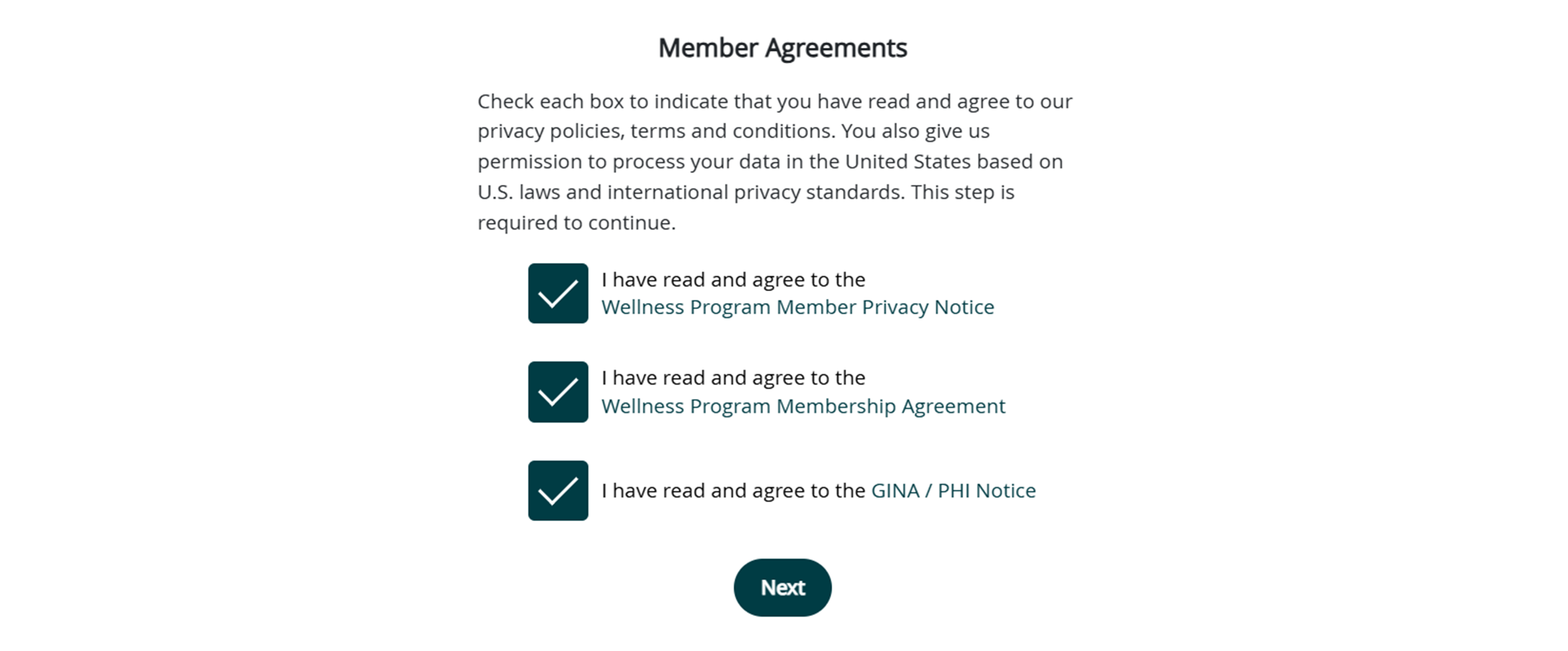

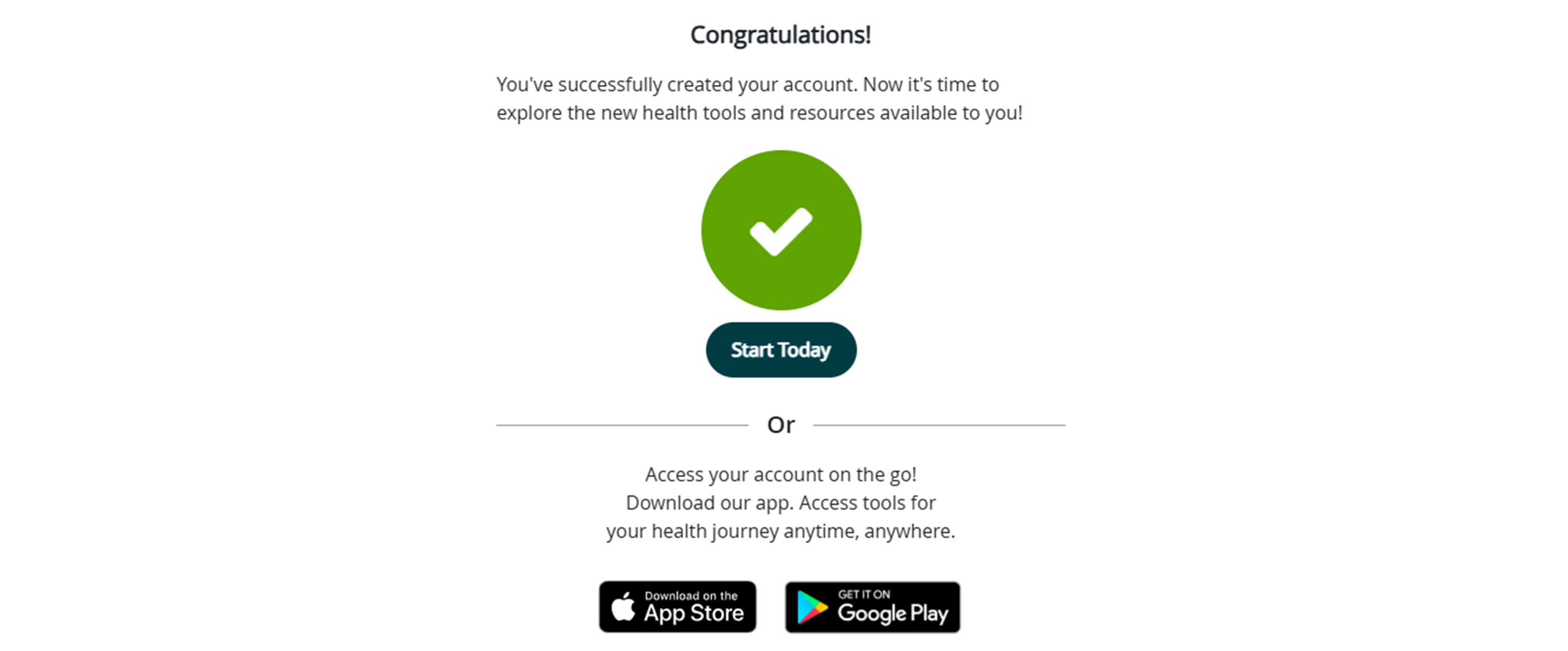

Your hub for well-being is the Hoos Well Portal, delivered by Personify Health. Click below to log in or create your account. Scroll down to view step-by-step registration instructions, reward-eligible activities, FAQs, and a short video to help you get started, active, and connected in the Hoos Well Portal.