Important Fee Update Regarding the UVA Retirement Program

The University of Virginia (UVA) is committed to ensuring our retirement plans are competitive, transparent, actively managed in cost effective ways, and easy to both access and understand. Our prudent approach to plan and vendor management necessitates intensive periodic and ongoing review of plan design and performance. We are happy to report that following our most recent review, we have taken the opportunity to redesign how the record keeping fees for managing our plans are administered. These changes make fees more transparent and ensure consistent application for all participants. These changes started in January 2025. This webpage outlines the changes and provides the required regulatory disclosures associated with these changes.

What is Changing?

Previously, the costs of managing our retirement plans were included in the overall investment expenses seen in your retirement account statements. That means that plan management record keeping fees were not shown separately and therefore were not visible to plan participants. Starting in 2025, these fees are visible to you and assessed as a simple, flat charge based on the vendor you use (TIAA or Fidelity).

Note: There have always been fees associated with plan management, paid by participants. This is not new. These changes make the fees more transparent, simplified, and equally distributed for all participants. Beginning in the first quarter of 2025, your account statements display a single fee based on your selected record keeping vendor (TIAA and/or Fidelity). The fee is assessed quarterly and outlined on your TIAA and/or Fidelity statements. If you have accounts with both TIAA and Fidelity, you will be charged once per record keeper.

Record Keeping Fee Holiday!

The best part: Highly effective plan management has afforded the University of Virginia the ability to cover the entirety of these record keeping fees for the plans on your behalf through the end of 2025. This results in a reduction in your retirement plan expenses (management fees) for a full 12 months. As we approach 2026, the specific fees associated with each vendor will be communicated separately.

Revenue Credit Begin in January 2025

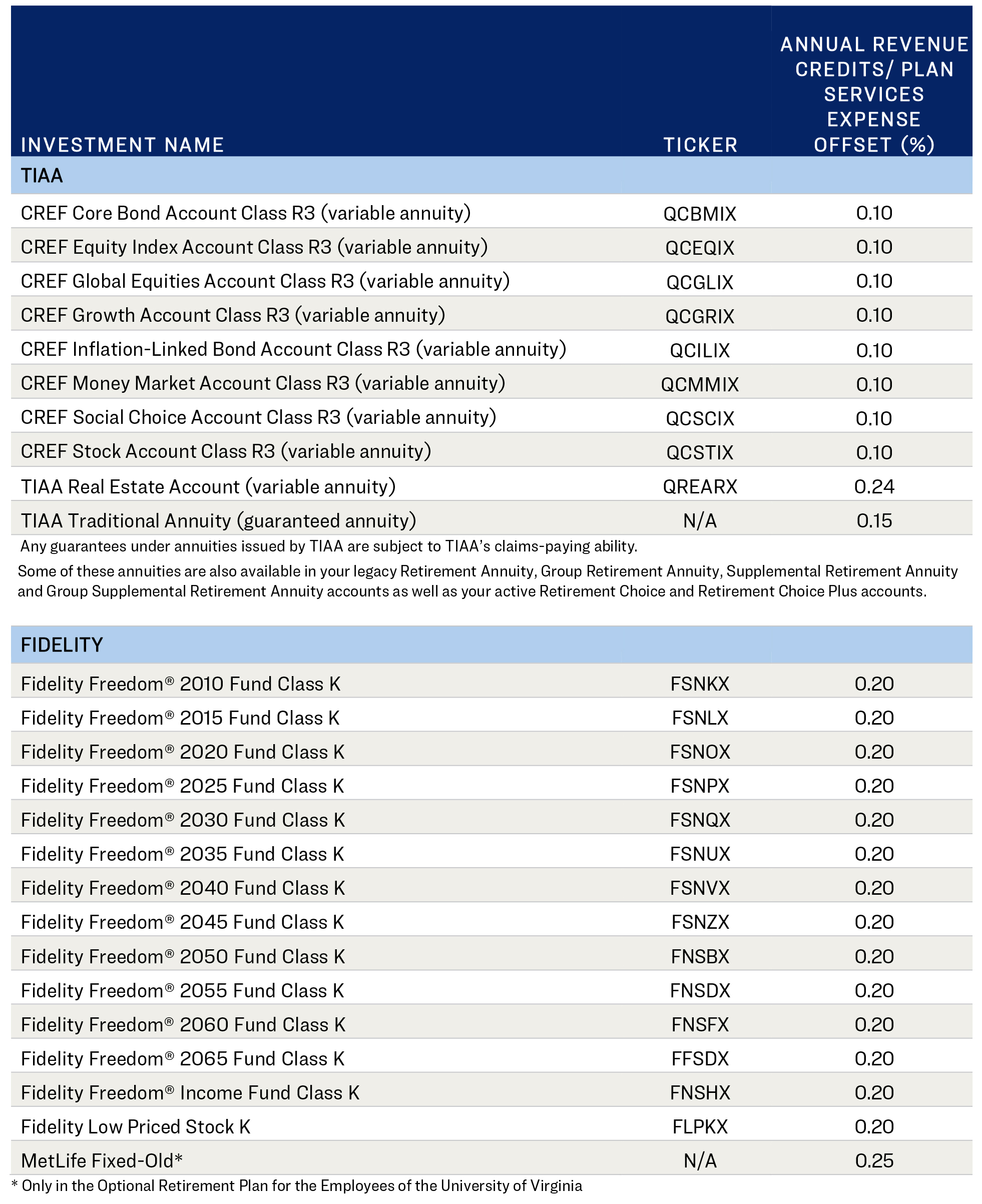

Retirement plan expenses include both management fees and investment fees. The UVA Retirement Plan offers many investment choices to meet your personal retirement goals. The specific investments you select come with different levels of fees. These fees can be seen when you select, review, or redistribute investments in your retirement portfolio. Some investment choices may offer revenue credits. Starting in January 2025, if any of your selected investments generate revenue credits, they will be credited back to your account at the end of each quarter beginning with your Q1 2025 statement, which are typically distributed around the end of April. Below is a chart showing which investments provide revenue credits.

Want more information? We are here to help.

We understand that fees related to retirement plan management can be confusing. However, they are a normal and necessary component of managing a retirement plan. For questions about your personal retirement portfolio and the investments you selected, we highly encourage you to take advantage of the tools and support services provided by TIAA and Fidelity. You can also find retirement plan information on the Retirement section of the HR website.

- TIAA: Visit tiaa.org/uva or call 800.842.2252.

- Fidelity: Visit netbenefits.com/uva or call 800.343.0860.