Get the most out of your UVA benefits

Open Enrollment is now closed.

If you have questions about your benefits or would like to make changes to your benefits outside of the Open Enrollment period and due to a qualified life event, please contact the HR Solution Center at AskHR@virginia.edu.

Open Enrollment is a time for all UVA benefits-eligible employees and team members to learn about, carefully review, and elect benefits for the following plan year starting January 1, 2025. These benefits include health and dental plan options, vision coverage, Health Savings Account, Flexible Spending Account, and Dependent Daycare Reimbursement Account.

Unless you experience a qualified life event like having a baby or getting married, making changes to these benefits can only be done during Open Enrollment, which this year runs October 7 through 18, 2024.

Learn what you need to know for your future emotional, physical, and financial well-being with in-person and virtual opportunities.

Do you know about UVA Health Employee Primary Care? This new clinic is open to all employees on the UVA Health Plan. Establish a relationship with a primary care provider or get same-day treatment for non-urgent care needs. Learn more about UVA Health Employee Primary Care.

UVA HR is here to help. Be a part of a healthy and connected community!

Here's What's Changing

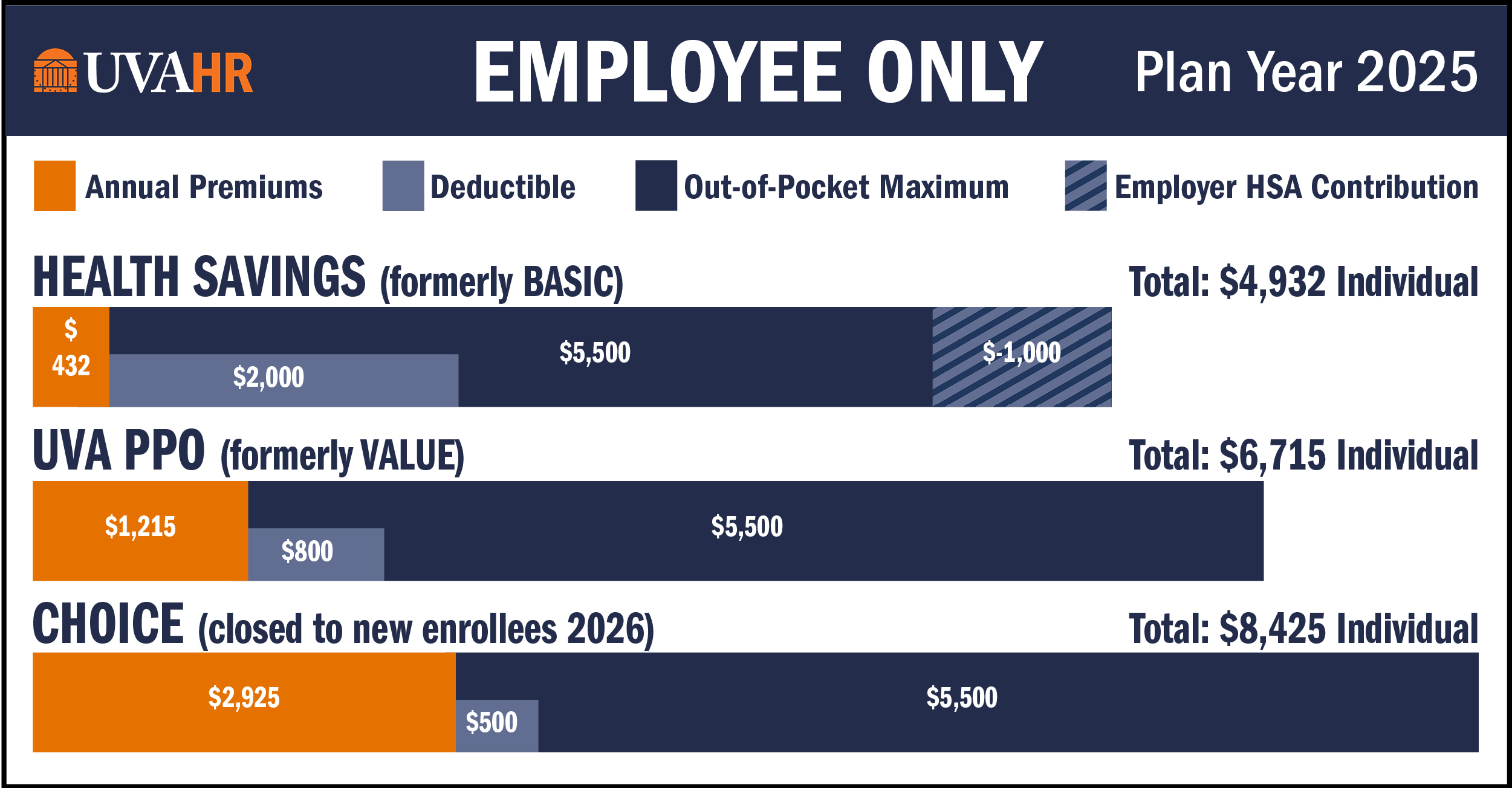

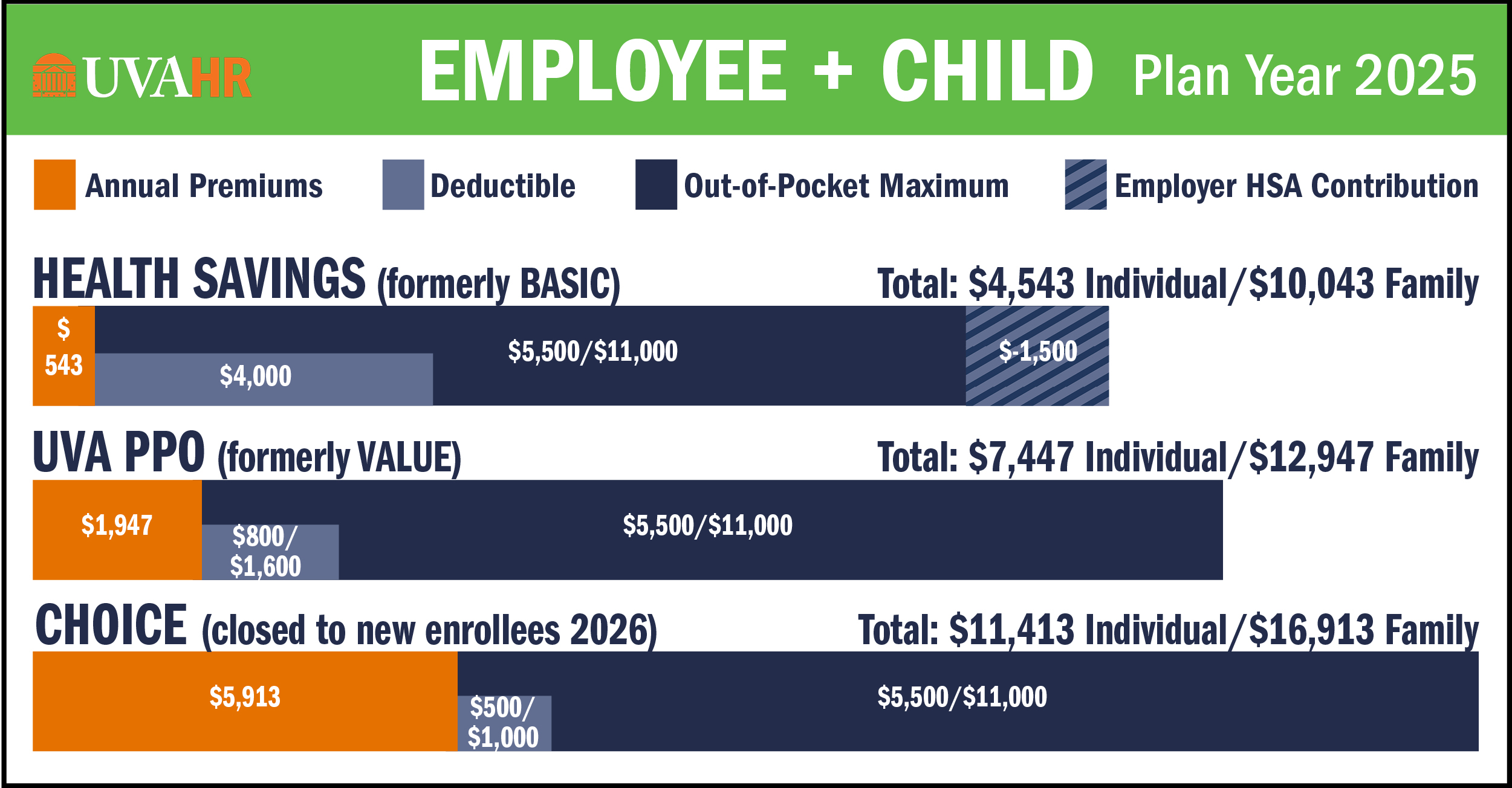

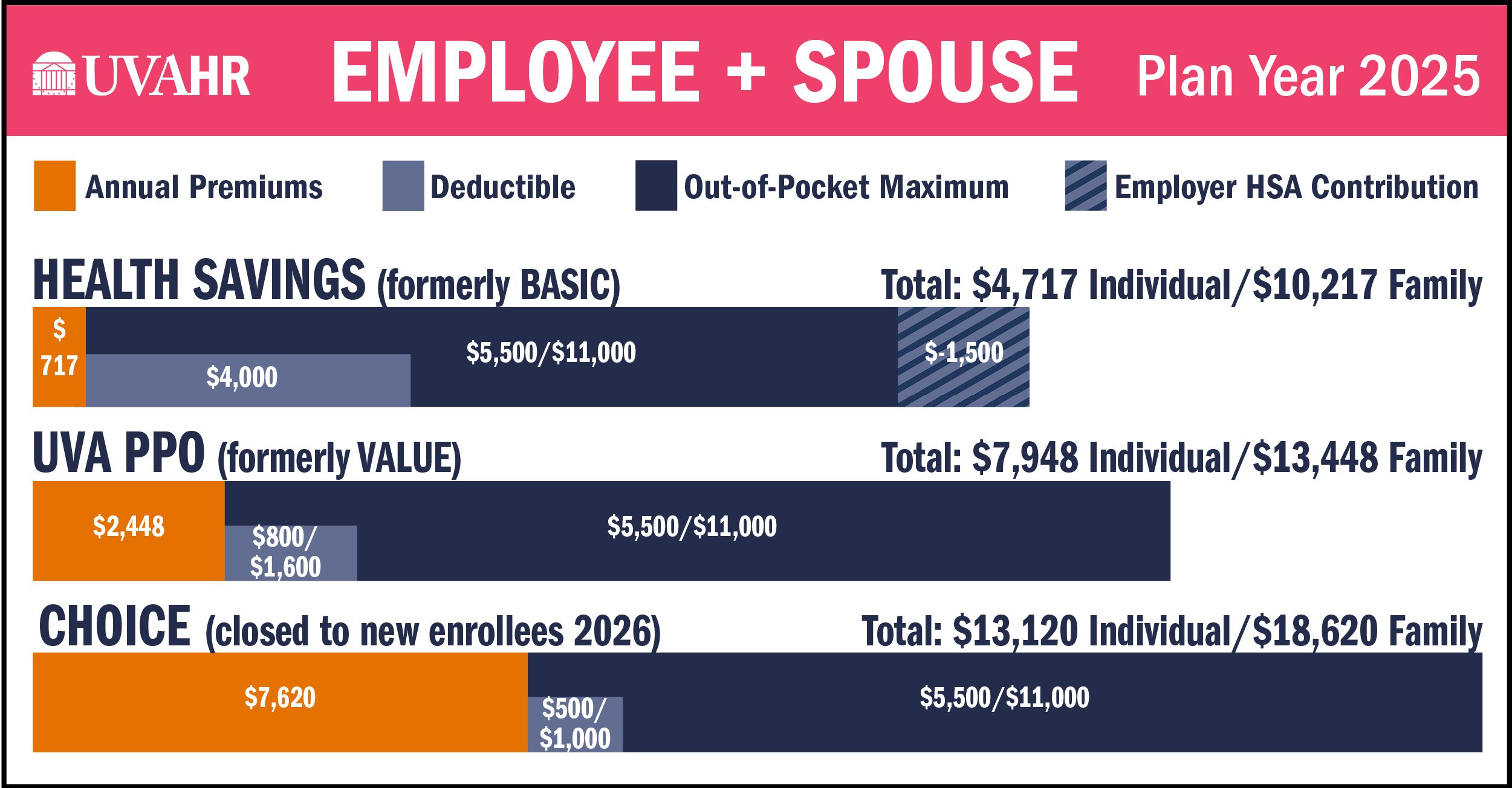

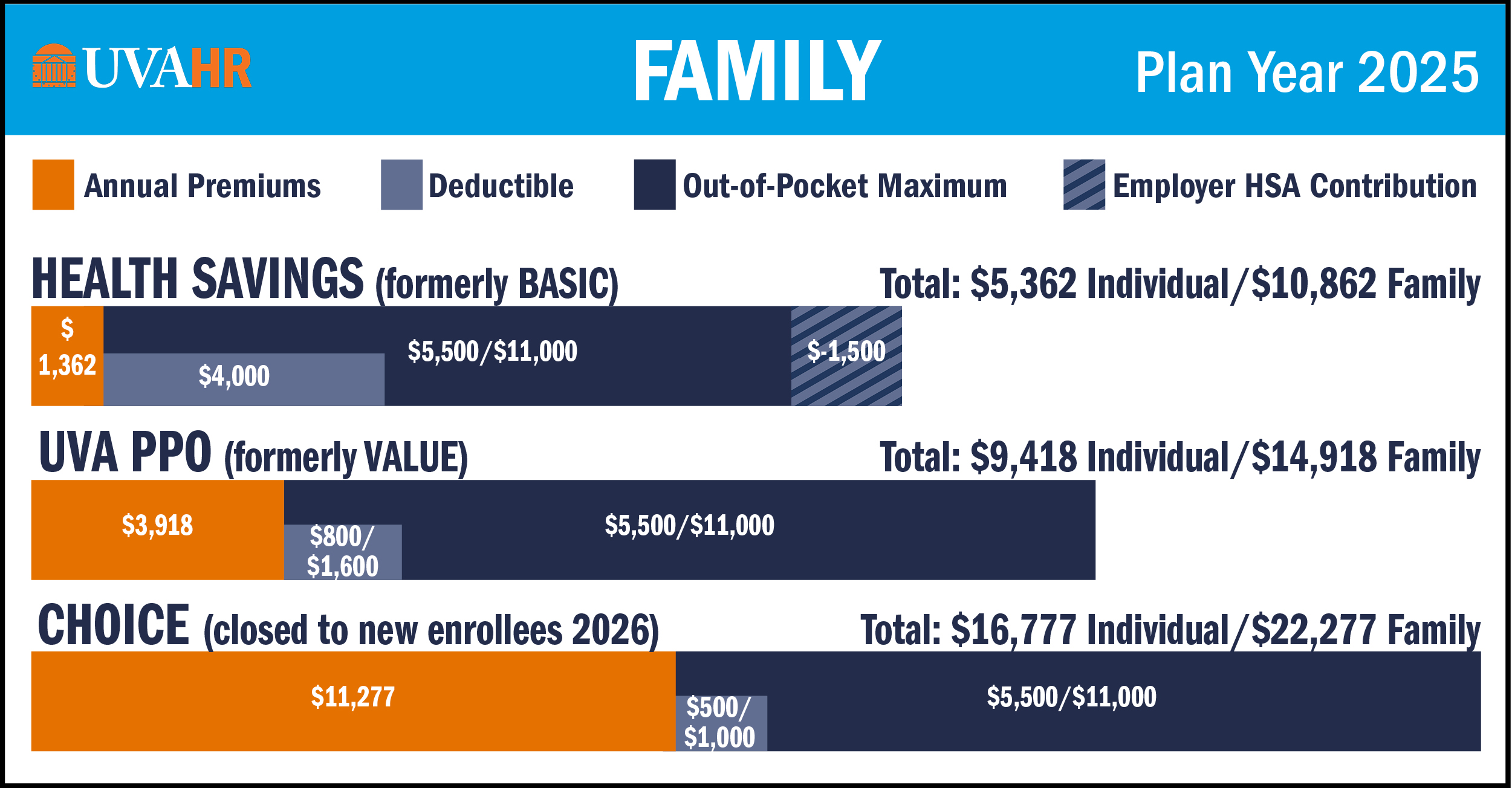

UVA Health Plan option names will change:

- Basic will become Health Savings

- Value will become UVA PPO

- Choice Health stays the same (closes to new enrollees starting 1/1/2026)

Health Plan Premiums: UVA Health Plan rates will increase to account for the rising costs in medical and prescription claims. As a self-insured health plan, the Plan is paid for by employee and employer contributions, and rising prices and employee utilization have an impact on the cost of the health plan. While employee premium rates will increase in 2025, the employer contribution will cover the greatest part of the increases.

See below premium rates for your employee type.

HSA Employee Contribution: The employee maximum contribution to the Health Savings Account for Health Savings participants will increase in 2025 (employee maximum contribution limits include employer seed funds, which will remain the same):

- Individual - $4,300 (from $4,150 in 2024)

- Family - $8,550 (from $8,300 in 2024)

- Catch-up (age 55+) - $1,000 (no change)