Prioritize Self-Care Using Your UVA benefits

Open Enrollment is now closed. You can make changes to your benefits if you have a "qualified life event." Learn more on the UVA HR Life Changes webpages.

From October 6–17, 2025, all UVA benefits-eligible employees and team members can review and select benefits for the 2026 plan year that starts January 1, without having a qualified event.

Take time to invest in your well-being and support those around you. Join us for in-person and virtual sessions designed to help you make informed decisions.

What to Know

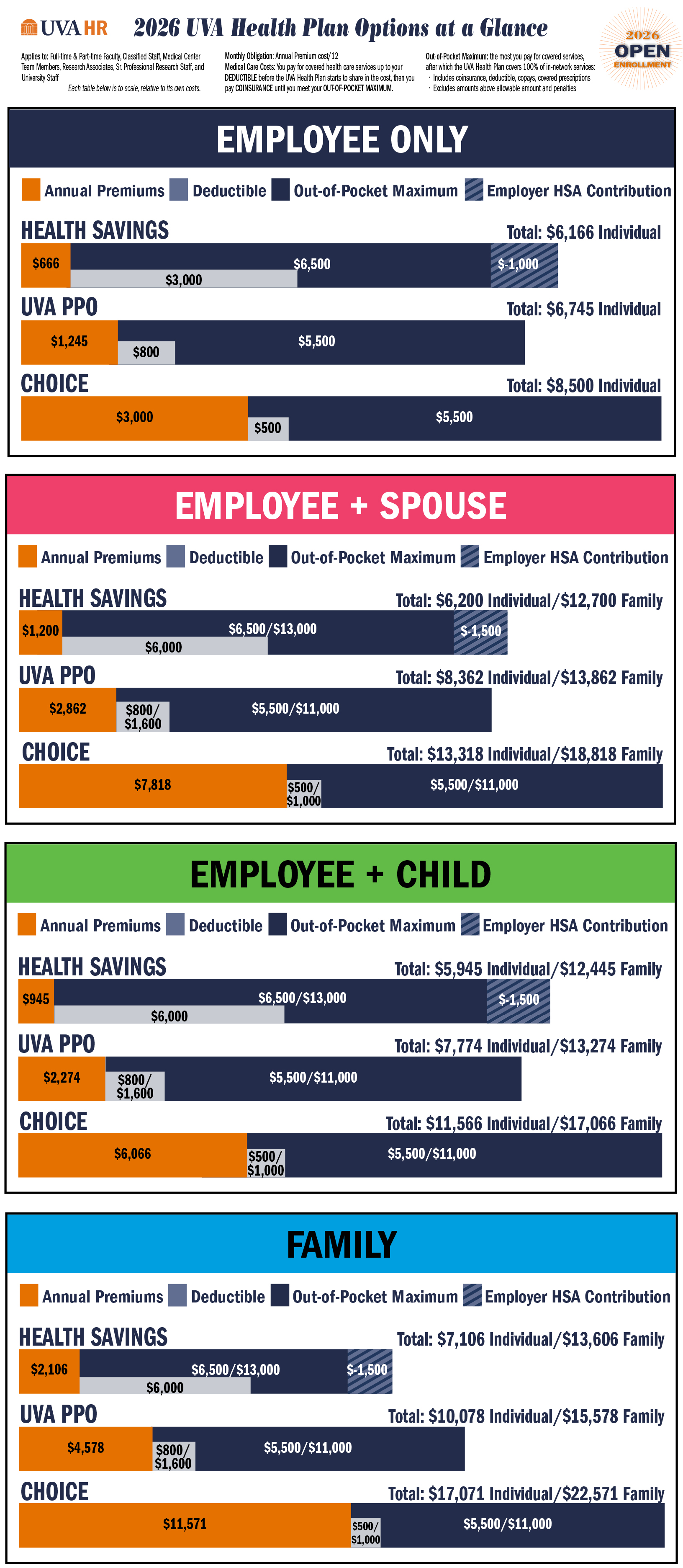

- The UVA Health Plan offers three plan options to choose from for 2026: Health Savings, UVA PPO and Choice Health. Choice Health will close to new enrollees starting January 1, 2026.

- Your health plan option and Health Savings Account (HSA) (if applicable) will carry over unless you make changes.

- Elections take effect January 1, 2026 and updated deductions will appear on your first paycheck in 2026.

- Premiums for the UVA Health Plan and UVA J Visa Health Plan will increase. See monthly premium rates below for your employee type.

- Deductibles and Out-of-Pocket Maximums will increase for participants in the Health Savings option.

- Access to primary care is getting better! Teladoc Virtual PCP (also known as Teladoc Primary 360) will soon offer UVA Health Plan participants convenient online visits for non-urgent health needs. Regular checkups with a primary care provider can help prevent chronic conditions and support long-term wellness.

Read more detailed information about the UVA Health Plan below.